Exploring the Bitcoin Cryptocurrency Market - Python Data Analysis

Max Lang / 2021-03-24

Cryptocurrencies - Python Data Analysis

Bitcoin was launched in 2008 since then many similiar currencies based on blockchain technology have emerged. The so called cryptocurrencies. Many of them are already extremly valuable e.g. Bitcoin, Bitcoin Cash or Etherum. However, investing in cryptocurrencies is extremly risky. The market is exceptionally volatile and any money you put in might disappear. As you can see at current events (Musk investing in Bitcoin etc.) the market is extremly volatile to this date. This data set was published on 6th December 2017 using the coinmarketcap API. (Source: coinmarketcap.com)

# imports

import pandas as pd

import matplotlib.pyplot as plt

# Setting aesthetics

plt.style.use('fivethirtyeight')

# Read in Data

filename= "/Users/max/Documents/My_Website/Data_Analysis_Projects/Exploring the Bitcoin Cryptocurrency Market/datasets/coinmarketcap_06122017.csv"

dec6 = pd.read_csv(filename)

# Subset 'id', 'market_cap_usd' columns

cols= ['id', 'market_cap_usd']

market_cap_raw = dec6[cols]

# Counting the number of values

market_cap_raw.count()## id 1326

## market_cap_usd 1031

## dtype: int64Simple Data Cleaning

The counts differ because some cryptocurrencies listed in coinmarketcap.com have no known market capitalization, this is represented by NaN in the data. The NaNs are not counted by count(). These cryptocurrencies are of little interest in this analysis, so they are safe to remove.

# Removing Coins withou market cap

cap = market_cap_raw.query('market_cap_usd > 0')

# Counting the number of values again --> match

cap.count()## id 1031

## market_cap_usd 1031

## dtype: int64Market capitalization of top 10 cryptocurrencies

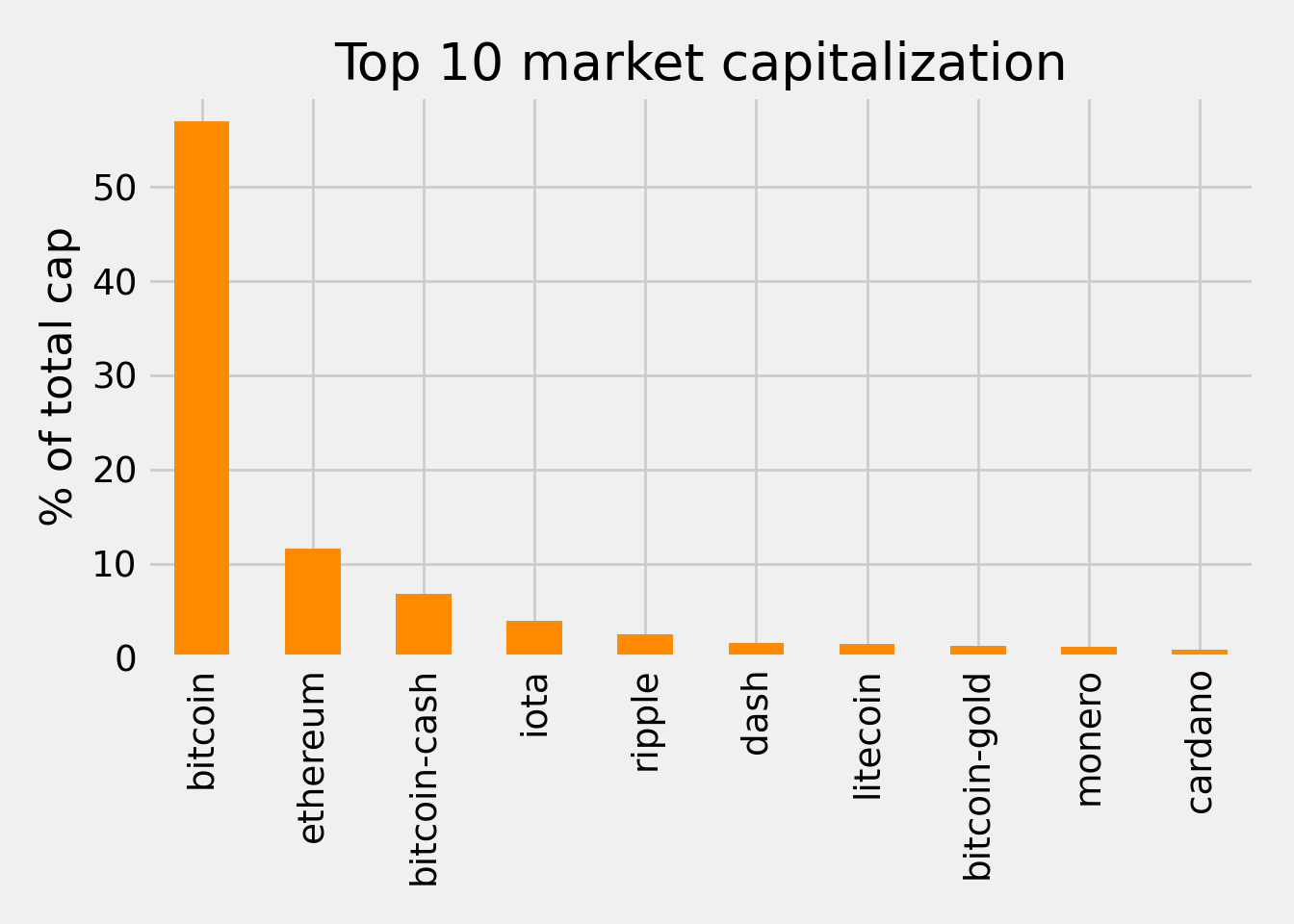

Bitcoin is was and is dominant in market capitalization, but many other are competing for the No.1 spot . The following plot shows the top 10 coins as a barplot. (Data from 2017!)

#Variables

title = 'Top 10 market capitalization'

ylabel = '% of total cap'

# Selecting top 10

cap10 = cap[:10].set_index('id')

# Calculating market_cap_perc

cap10 = cap10.assign(market_cap_perc = lambda x: (x.market_cap_usd / cap.market_cap_usd.sum())*100)

# Plotting

ax = cap10.market_cap_perc.plot.bar(title=title, color= "darkorange")

# Annotations

ax.set_ylabel(ylabel);

ax.set_xlabel("")

plt.tight_layout()

plt.show()

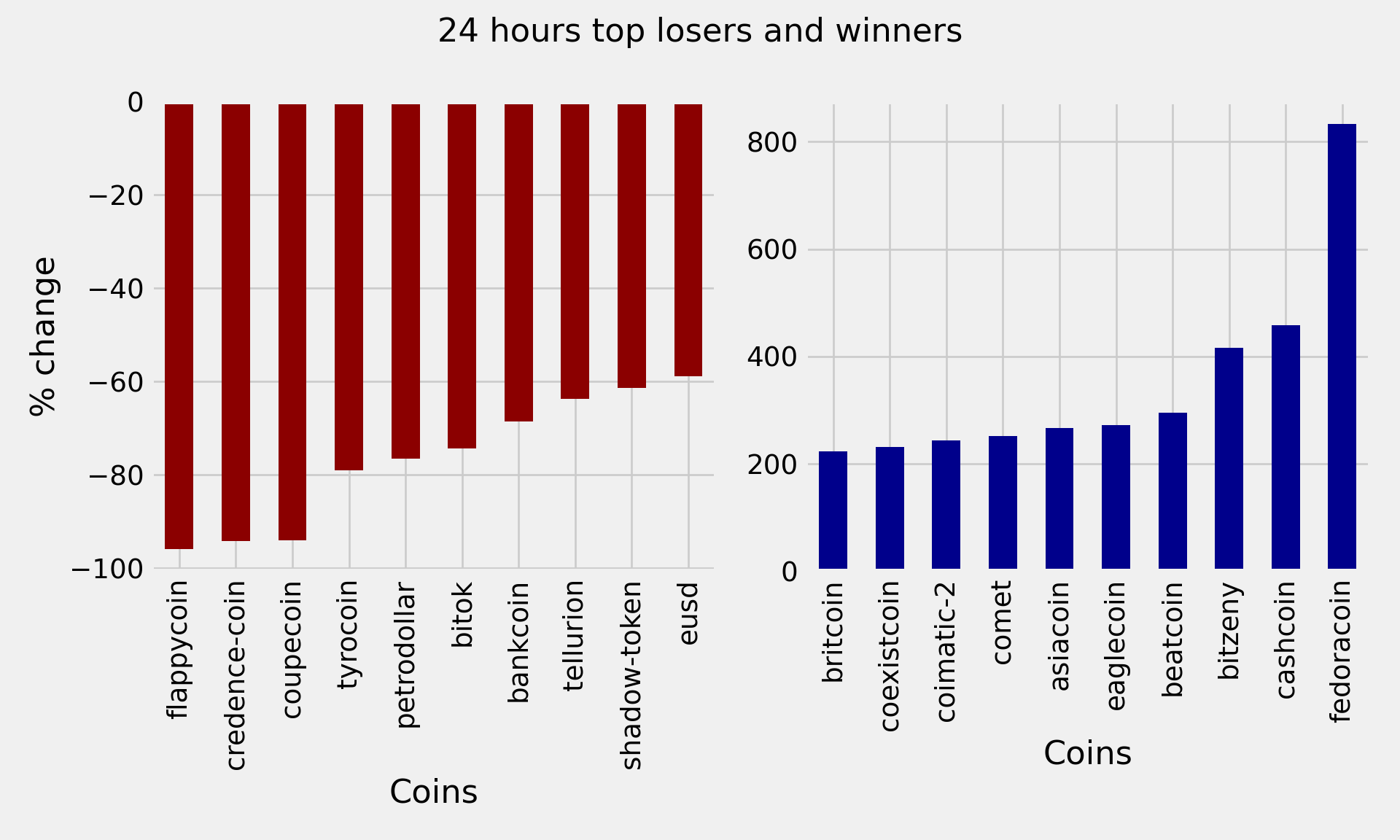

Volatility in cryptocurrencies

The cryptocurrencies market has been spectacularly volatile to this day. The next chunk shows the 24 hours and 7 days percentage change, which we already have available.

# Subset id, percent_change_24h and percent_change_7d columns

cols= ['id', 'percent_change_24h', 'percent_change_7d']

volatility = dec6[cols]

# Set index to 'id'

volatility = volatility.set_index('id').dropna()

# Sorting by percent_change_24h in ascending order

volatility = volatility.sort_values(by= "percent_change_24h", ascending= True)

# Check

print(volatility.head())## percent_change_24h percent_change_7d

## id

## flappycoin -95.85 -96.61

## credence-coin -94.22 -95.31

## coupecoin -93.93 -61.24

## tyrocoin -79.02 -87.43

## petrodollar -76.55 542.96Well, we can already see that things are a bit crazy It seems you can lose a lot of money quickly on cryptocurrencies . The next plot shows the top 10 biggest gainers and top 10 losers in market capitalization. For that I defined a function which is shown in the enxt chunk.

# function with 2 parameters

def top10_subplot(volatility_series, title):

# creating subplots

fig, axes = plt.subplots(nrows=1, ncols=2, figsize=(10, 6))

# Plotting barchart

ax = volatility_series[:10].plot.bar(color="darkred", ax=axes[0],xlabel= "Coins")

# Annotations

fig.suptitle(title)

ax.set_ylabel('% change')

# top 10 winners

ax = volatility_series[-10:].plot.bar(color="darkblue", ax=axes[1],xlabel= "Coins")

return fig, ax

TITLE = "24 hours top losers and winners"

# Calling the function above with the volatility.percent_change_24h series

# and title DTITLE

fig, ax = top10_subplot(volatility.percent_change_24h, TITLE)

plt.tight_layout()

plt.show()

800% daily increase?! That is absolutely insane. Let’s check the weekly changes.

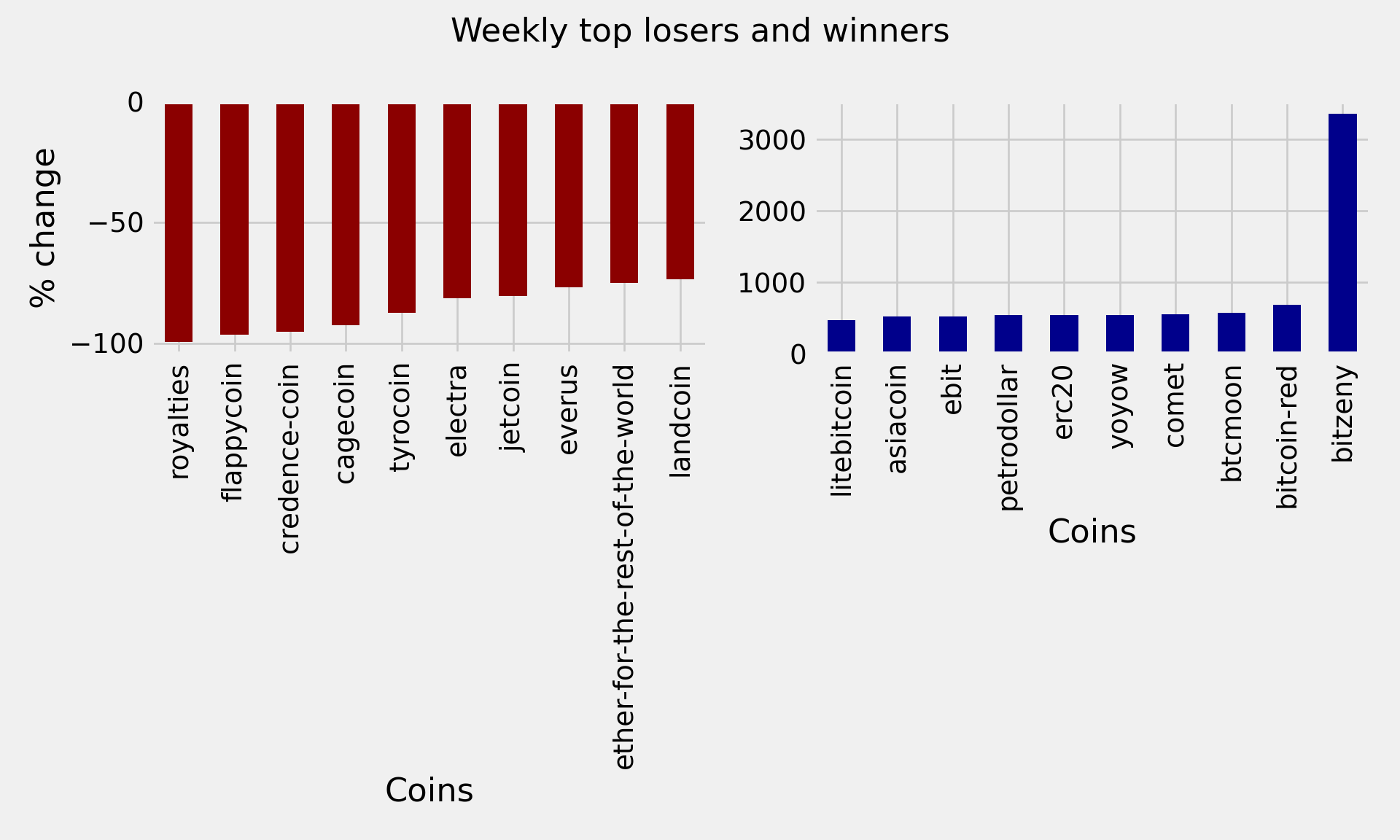

# Sorting percent_change_7d in ascending order

volatility7d = volatility.sort_values("percent_change_7d")

TITLE = "Weekly top losers and winners"

fig, ax = top10_subplot(volatility7d.percent_change_7d, TITLE);

plt.tight_layout()

plt.show()

Large Coins

The names of the cryptocurrencies above are quite unknown, and there is a considerable fluctuation between the 1 and 7 days percentage changes. As with stocks, and many other financial products, the smaller the capitalization, the bigger the risk and reward. Smaller cryptocurrencies are less stable projects in general, and therefore even riskier investments than the bigger ones. Cryptocurrencies are a new asset class, so they are not directly comparable to stocks. Furthermore, there are no limits set in stone for what a “small” or “large” stock is. Finally, some investors argue that bitcoin is similar to gold. I just defined the “large” as 10 billion market capitalization. In the next chunk you can see the biggest coins (2017).

# Coins with more than 10 billion market capitalization

largecaps = cap.query("market_cap_usd > 1E+10")

largecaps## id market_cap_usd

## 0 bitcoin 2.130493e+11

## 1 ethereum 4.352945e+10

## 2 bitcoin-cash 2.529585e+10

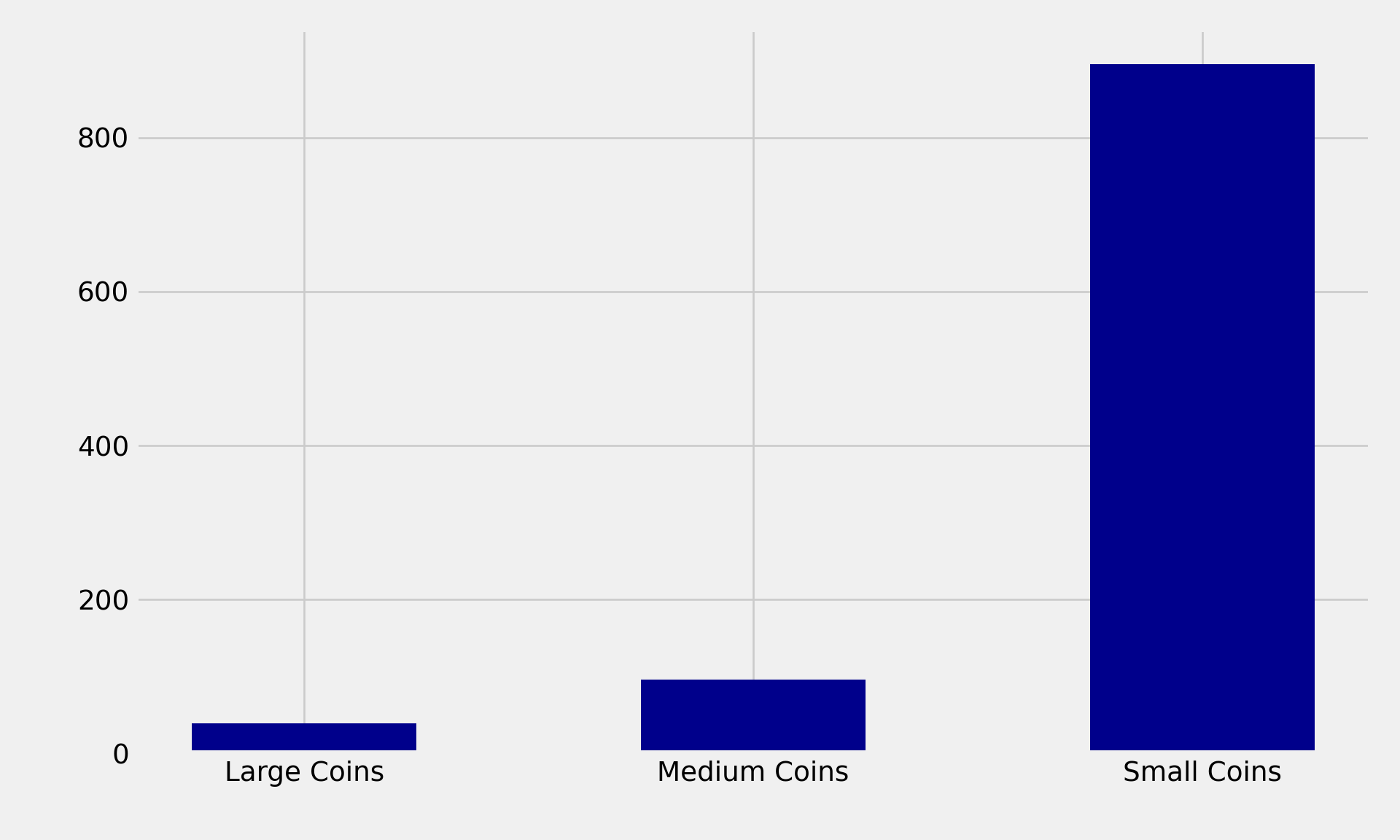

## 3 iota 1.475225e+10Most coins are tiny. As you can see in the following bar chart most crypto-coins are small.

The categories are like the following

* Large is more than 300.000.000 in market_cap_usd

* Medium is more or equal to 50.000.000 in market_cap_usd

* Small is less than 50.000.000 in market_cap_usd

def capcount(query_string):

return cap.query(query_string).count().id

# Labels for the plot

LABELS = ["Large Coins", "Medium Coins", "Small Coins"]

large = capcount("market_cap_usd > 3E+8")

medium = capcount("market_cap_usd >= 5E+7 & market_cap_usd < 3E+8")

small = capcount("market_cap_usd < 5E+7")

values = [large, medium, small]

# Plotting

plt.bar(range(len(values)), values, tick_label=LABELS, color="darkblue", width= 0.5);

plt.tight_layout()

plt.show()